franklin county ohio sales tax rate 2020

You can print a 7 sales tax table here. A A A.

Washington Sales Tax Guide For Businesses

The tax rate was increased to 4 effective September 1 1980 and to 6 effective September 1 1985.

. There is no applicable city tax or special tax. The Franklin County sales tax rate is. This is the total of state and county sales tax rates.

The December 2020 total local sales tax rate was also 7500. 2020 Business Tax Return. If your address is current with the nc.

All eligible tax lien certificates are bundled together and sold as part of a single portfolio. City of Columbus and Franklin County Facilities Authority Hotel-Motel Excise Tax. Voter Registration Search Board of Elections.

1 Benjamin Franklin Way Franklin Ohio 45005. To learn more about real estate taxes click here. 1st Quarter effective January 1 2020 - March 31 2020 There were no sales and use tax county rate changes effective January 1 2020.

Child Support Child Support Enforcement. Franklins Income Tax Rate is 2 effective July 1 2011. Ohio Works First Applicant Job Search Job Family Services.

Ohio sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. What is the sales tax rate in Franklin County. Imposed a 4 county-wide tax rate which the City collects on its behalf and remits to the FCCFA.

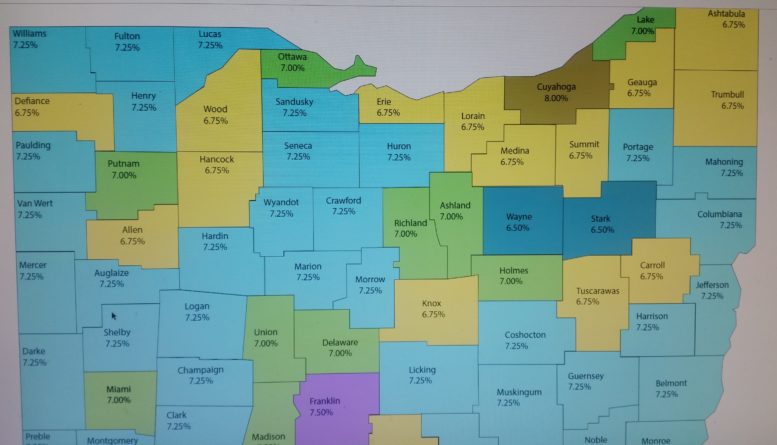

The current total local sales tax rate in Franklin County OH is 7500. The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales tax and 175 Franklin County local sales taxesThe local sales tax consists of a 125 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. Thats why we came up with this handy Ohio sales tax calculator.

2015 franklin county tax rates. Our office is open Monday. The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax.

This is the total of state county and city sales tax rates. John Smith Street Address Ex. Food Assistance Job Family Services.

Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the entire delinquency. Groceries and prescription drugs are exempt from the Ohio sales tax Counties and cities can charge an additional local sales tax of up to 225 for a. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

Franklin 125 050 750 Putnam 125 700 Fulton 150 725 Richland 125 700 Gallia 150 725 Ross 150 725. Did South Dakota v. Sales Tax Breakdown Grove City Details Grove City OH is in Franklin County.

The latest sales tax rate for Franklin OH. The County assumes no responsibility for errors. There also is a 05 percent.

The Ohio state sales tax rate is 575 and the average OH sales tax after local surtaxes is 71. A county-wide sales tax rate of 125 is applicable to localities in Franklin County in addition to the 575 Ohio sales tax. 2021 Business Estimated Payment Vouchers.

The franklin ohio general sales tax rate is 575. Local tax rates in Ohio range from 0 to 225 making the sales tax range in Ohio 575 to 8. 2018 Business Tax Instructions.

This is the total of state and county sales tax rates. If you have any questions regarding your property taxreal estate tax you may call Warren County Auditor at 513-695-1300 or visit the Auditors website. 2020 rates included for use while preparing your income tax deduction.

Create your own online store and start selling today. Franklin county oh sales tax rate. Some cities and local governments in Franklin County collect additional local.

Find your Ohio combined state and local tax rate. The Franklin County Sales Tax is 125. Our office is open Monday through Friday 800 am.

The minimum combined 2022 sales tax rate for Franklin Ohio is 7. The december 2020 total local sales tax rate was also 7500. Franklin county ohio sales tax rate 2022 up to 75.

Auto Title Clerk of Courts. Municipal Net Profit Tax Net Operating Loss Deduction Worksheet. There were no sales and use tax county rate changes effective July 1 2020.

ZIP County Rate ZIP County Rate ZIP County Rate ZIP County Rate County Rate Table by ZIP Code May 2022 43001 Licking 725 43002 Franklin 750 43003 Delaware 700 43003 Morrow 725 43004 Franklin 750 43004 Licking 725 43005 Knox 725 43006 Coshocton 775 43006 Holmes 700 43006 Knox 725 43007 Union 700 43008. The minimum combined 2022 sales tax rate for Franklin County Ohio is. 2019 Business Tax Return.

The 2018 United States Supreme Court decision in South Dakota v. For tax rates in other cities see Ohio sales taxes by city and county. The Franklin sales tax rate is 0.

The Franklin County Sales Tax is collected by the merchant on all qualifying sales made within. Overview of the Sale. 2020 Business Tax Instructions.

Franklin WH Booklet 21. Delinquent tax department franklin county treasurers office 373 south high street 17th floor columbus ohio 43215. Rates listed by city or village and Zip code.

The ohio state sales tax rate is currently. 2019 Business Tax Instructions. This rate includes any state county city and local sales taxes.

The Ohio sales tax rate is currently 575. The County assumes no responsibility for errors. Wayfair Inc affect Ohio.

Michael stinziano 2019 property tax rates for 2020 franklin county auditor expressed in dollars and cents on each one thousand dollars of assessed valuation libr local city voc non business credit owner occupancy non business owner occupancy credit dst spec cnty twp school vill school total class 1 class 2 no. The Ohio state sales tax rate is currently. The December 2020 total local sales tax rate was also 7500.

Building Permits Economic Development Planning. Search for a Property Search by. 2nd Quarter effective April 1 2020 - June 30 2020 Rates listed by county and transit authority.

The County sales tax rate is 125. The December 2020 total local sales tax rate was also 7500. 2018 Business Tax Return.

The sales and use tax rate for paulding county 63 will decrease from 725 to 675 effective october 1 2021 map of. Name Change Probate Court. Franklin furnace oh sales tax rate.

Effective January of 1989. 123 Main Parcel ID Ex.

Washington Property Tax Calculator Smartasset

Sales Taxes In The United States Wikiwand

Solving Sales Tax Applications Prealgebra

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Sales Taxes In The United States Wikiwand

Ohio Sales Tax Rates By City County 2022

State Local Property Tax Collections Per Capita Tax Foundation

Sales Taxes In The United States Wikiwand

Solving Sales Tax Applications Prealgebra

Greater Dayton Communities Tax Comparison Information

Washington Sales Tax Rates By City County 2022

Montgomery County Md Property Tax Calculator Smartasset

Wood County Likes Its Status On Low Sales Tax Island Bg Independent News

States With Highest And Lowest Sales Tax Rates

Indiana Retirement Tax Friendliness Smartasset

Kansas Sales Tax Rates By City County 2022

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com